Table of Content

- Sony’s $200 DualSense Edge for PS5 will have ‘moderately shorter’ battery life

- Stores Related To Blinds.com

- Save With Special Offers

- Market Brief

- Roman shades for up to 45% off for a limited time

- PlayStation userbase "significantly larger" than Xbox even if every COD player ditched Sony, Microsoft says

- Applying to DePaul

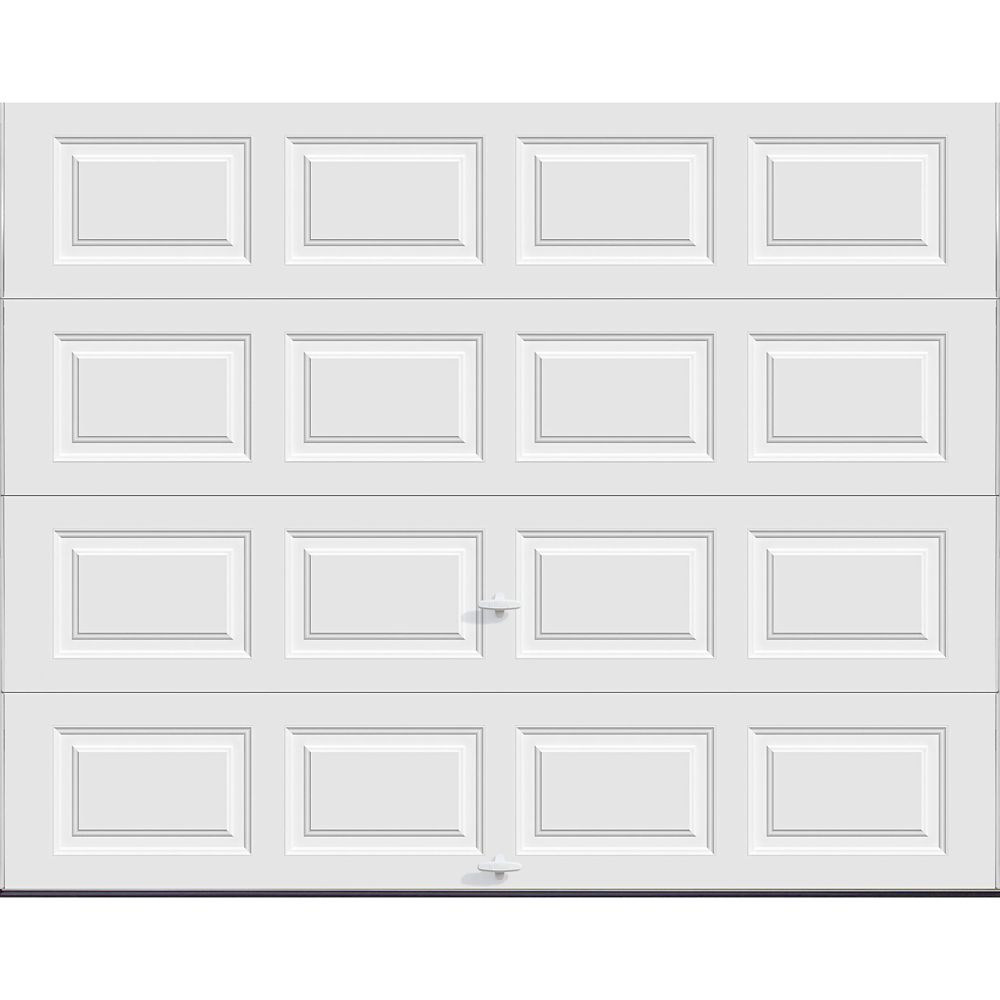

Today, many companies are now exploring new underwriting models that return to core principles – assessing ability to repay without attempting to use outside information to model a consumer’s presumed ability to repay. Blinds.com shipping is free for all destinations in the continental United States. For oversized products that exceed 96” in height or width, Blinds.com customer service will get in touch with you regarding the shipping fee and other information. Take all the work out of installing your blinds with help from a Blinds.com pro.

Because they know that each window is different, Blinds.com offers coverings that are completely customizable with your preferred color and options. "While Sony may not welcome increased competition, it has the ability to adapt and compete. Gamers will ultimately benefit from this increased competition and choice. Copyright © 2022 At Home Stores LLC. Selection, quantities and pricing of products may vary by participating store. Join Insider Perks for FREE access to select flash find prices, a welcome coupon and be the first to know about new arrivals. Sign up for Verge Deals to get deals on products we've tested sent to your inbox daily. Financial services are an essential part of our economic plumbing, and we will be working to let the market expand and develop new ways to help Americans live their lives to the fullest.

Sony’s $200 DualSense Edge for PS5 will have ‘moderately shorter’ battery life

Microsoft says these same principles will also apply to the future Xbox mobile store, which could be enough to lure developers onto the platform. One company that might be particularly interested is Epic Games, which has allied itself with Microsoft in the past few years in the fight against Apple’s App Store policies. "The suggestion that the incumbent market leader, with clear and enduring market power, could be foreclosed by the third largest provider as a result of losing access to one title is not credible," Microsoft told GamesIndustry.biz. If the UK battles are anything to go by, this acquisition could get messy as Microsoft and Sony battle it out behind the scenes to sway regulators. Microsoft even has a dedicated website to highlight its arguments as it seeks to convince regulators that its giant deal isn’t a bad one for gamers. We’re still months away from final regulator decisions, but get ready for this battle to continue to spill out onto the internet’s streets.

Read the CFPB’s recent enforcement action against Regions Bank for charging surprise overdraft fees. An overdraft fee can become a surprise fee when the customer doesn’t reasonably expect their actions to incur an overdraft fee. For instance, even if a person closely monitors their account balances and carefully manages their spending to avoid overdraft fees, they can easily incur penalties when financial institutions employ processes that are unintelligible or manipulative.

Stores Related To Blinds.com

Decades before, the so-called Carterfone rules ensured that new devices could be interoperable with AT&T’s network, through standardized jacks and plugs, even if produced by third parties. The company also has regular sitewide Blinds.com sales, such as 40% off on selected items. To use any Blinds.com promo codes or Blinds.com coupon codes, simply enter them into the appropriate box before checkout. But even if Call of Duty stays on PlayStation, Sony could still lose out on serious revenue if Microsoft offers the title on Xbox Game Pass. Microsoft previously claimed that Sony is paying for “blocking rights” to keep some games off Xbox Game Pass and now says that’s the case with Call of Duty. “The agreement between Activision Blizzard and Sony includes restrictions on the ability of Activision Blizzard to place Call of Duty titles on Game Pass for a number of years,” says Microsoft in its filings.

Regions is required to, among other consequences, reimburse consumers all the funds it unlawfully charged since August 2018 and pay a $50 million penalty. Overdraft and depositor fees likely violate the Consumer Financial Protection Act prohibition on unfair practices when consumers cannot reasonably avoid them. Today’s Consumer Financial Protection Circular on surprise overdraft fees and the CFPB’s compliance bulletin on surprise depositor fees lay out when a financial institution’s back-end penalties likely break the law. And, as for companies looking to draw in new customers – when consumers authorize transfers of their personal financial data, new providers will be able to treat them as if they have been long-time customers. Because of the authorized data, companies will immediately know the products and services that could best fit their new customers’ needs.

Save With Special Offers

I’ll then outline some details about where we are headed, as well as what we are hoping to avoid. When a consumer deposits a check that bounces, banks sometimes charge a fee to the depositor, usually in the range of $10 to $19. However, a person trying to deposit a check has no idea or control over whether the check will clear, and sometimes, that person is the victim of check fraud. In fact, there are many reasons deposited checks can bounce, and the most common reason is that the check originator does not have enough money available in their account. Charging a fee to the depositor penalizes the person who could not anticipate the check would bounce, while doing nothing to deter the originator from writing bad checks.

For a flat fee of $199, you can have a pro come to verify your measurements and install your new blinds. To get started, add all of your Blinds.com shutters, faux wood blinds, or woven wood shades to your cart and click "Add Installation" to schedule your pro installation. Fill your cart and reduce the price by an extra 5% when you enter this Blinds.com coupon at checkout. Add new Blinds.com shutters, roman shades, and more styles for $20 off with this coupon. Prop 30’s solution undermines funding for public education, health care, seniors, and other essential services while forcing taxpayers to pick up the tab for large corporations.

Free samples with every purchase

Today’s Consumer Financial Protection Circular explains that when financial institutions charge surprise overdraft fees, sometimes as much as $36, they may be breaking the law. The circular provides some examples of potentially unlawful surprise overdraft fees, including charging penalties on purchases made with a positive balance. These overdraft fees occur when a bank displays that a customer has sufficient available funds to complete a debit card purchase at the time of the transaction, but the consumer is later charged an overdraft fee. Often, the financial institution relies on complex back-office practices to justify charging the fee. For instance, after the bank allows one debit card transaction when there is sufficient money in the account, it nonetheless charges a fee on that transaction later because of intervening transactions.

Employees who believe their companies have violated federal consumer financial protection laws are encouraged to send information about what they know to The bulletin explains that indiscriminately charging these depositor fees, regardless of circumstances, likely violates the Consumer Financial Protection Act. Enjoy up to 40% off your entire purchase plus an extra 5% off select shades and window treatments using this Blinds.com coupon for a limited time. The CMA and other regulators now have the unenviable task of untangling these arguments between Sony and Microsoft and figuring out exactly how this deal could harm consumers or competition.

– Today, the Consumer Financial Protection Bureau issued guidance about two junk fee practices that are likely unfair and unlawful under existing law. The first, surprise overdraft fees, includes overdraft fees charged when consumers had enough money in their account to cover a debit charge at the time the bank authorizes it. The second is the practice of indiscriminately charging depositor fees to every person who deposits a check that bounces.

Tens of thousands of people responded to a CFPB Request for Information with their stories and complaints about unnecessary fees in banking. Since then, the CFPB has taken action to constrain “pay-to-pay” fees, and has announced a rulemaking proceeding on credit card late fees. In the last year, the CFPB has also published several research reports on overdraft fees and an analysis of college banking products. However, a big potential stumbling block for Microsoft’s mobile gaming ambitions could be its control of Call of Duty on both mobile and console.

However, the CMA has barely discussed the potential for Microsoft’s entrance into mobile gaming as part of its investigation and is instead largely focusing on console gaming, which Microsoft argues is an increasingly smaller part of the overall market. In a graph posted at Microsoft’s Activision Blizzard acquisition site, the company depicts the entire gaming market as worth $165 billion in 2020, with consoles making up $33 billion , PCs at $40 billion , and mobile gaming at $85 billion . Importantly, a more open market will also make sure consumers won’t have to start from scratch. For example, Americans often use their deposit account history as a life ledger – it is a written record that keeps track of payments and deposits, which can be helpful for taxes, for disputes with merchants, or insurers, and for other purposes. By allowing consumers to transfer their ledger to a new institution, the rule could make switching institutions easier – you won’t need to maintain a relationship with your bank to maintain your written record. The Federal Communications Commission’s number portability rules reduced switching costs by allowing customers to move their phone number to a new carrier.

Like other home décor retailers, we work with a variety of partners to source our products, making each one unique to At Home. “After almost 20 years ofCall of Dutyon PlayStation, their proposal was inadequate on many levels and failed to take account of the impact on our gamers,” said PlayStation head Jim Ryan in response. In closing, it is important to remind ourselves about why the United States has historically been a bastion of discovery and progress. We are at our best when our laws and rules facilitate seamless switching, reduce barriers to entry, eliminate conflicts of interest, and prevent infrastructure providers from denying access to critical networks.

While we expect to cover more products over time, we are starting with these ones. Through these transaction accounts, the rule will be able to facilitate new approaches to underwriting, payment services, personal financial management, income verification, account switching, and comparison shopping. Financial regulators have largely complied with what dominant incumbents desire by writing complicated rules to fit existing business models. Much of it involves financial institutions handing consumers a lot of fine print that they may not even read, like those financial privacy notices companies send. Likewise, nascent firms would be able to use data permissioned by consumers to improve upon and customize, to provide greater access, and to develop products and services. Under the current regime, nascent firms often find themselves in the position of needing to curry favor with big market players.

That means a push into mobile gaming could happen on multiple fronts — not just on phones and tablets. The UK regulator signaled an in-depth review of Microsoft’s $68.7 billion deal to acquire Activision Blizzard last month, and the CMA has now published its full 76-page report on its findings. The CMA says it has concerns that Microsoft’s Activision Blizzard deal could lessen competition in game consoles, subscriptions, and cloud gaming, but Microsoft thinks the regulator has simply been listening to Sony’s lawyers too much. The CFPB is subject to a rulemaking step that is unique among financial regulators. Before issuing a proposed rule, the CFPB must convene a panel of small businesses that represent their markets to provide input on our proposals.

No comments:

Post a Comment